With another strong year in the stock market, it’s time for investors to celebrate! While marveling at the growth of your portfolio is satisfying, a more rewarding way to celebrate is to actually spend some of those phenomenal returns on things that bring joy and fulfillment.

Stocks, by themselves, provide no utility. We invest in them for a purpose—whether it’s financial security, achieving a specific goal, or simply enjoying life. If you’ve reached or surpassed your financial goals, selling some stocks occasionally to fund your desired lifestyle makes perfect sense.

The challenge for many investors is that we love making money so much, we hesitate to ever sell. Over time, this mindset can turn us into wealthy misers, hoarding wealth but never fully enjoying the fruits of our labor.

When I turned 45 in 2022, I decided to be more intentional about decumulating wealth. Shifting gears after a lifetime of saving and investing aggressively hasn’t been easy. I have an inability to spend money on myself, but no problem on others.

But, consumption smoothing is important. By striking the right balance, we can maximize our lifestyles and make the most of the wealth we’ve worked so hard to build.

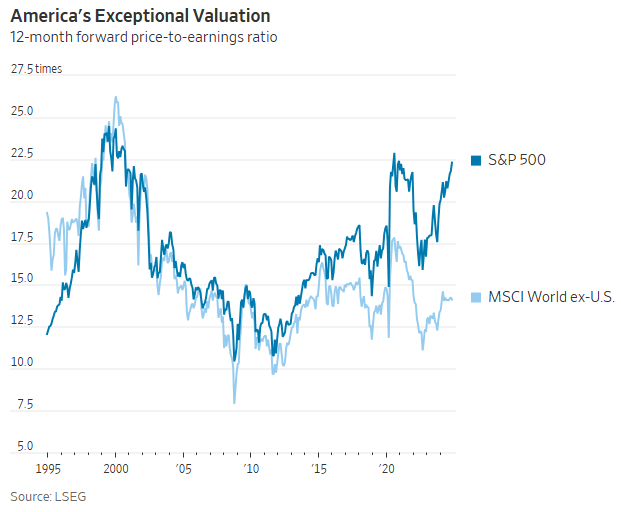

Besides, stocks are expensive. Why not trade some expensive currency and buy something inexpensive and enjoyable just in case the market corrects again?

Fun and Practical Things to Buy With Your Huge Stock Market Returns

Let me provide a variety of items to buy, given we all have different amounts we've made in the stock market. In the past, I would have a hard time coming up with a list of fun things to buy. But not this year!

I currently own and use every single one of these items.

1) Cincom Hand Massager – Under $60

For those of you who regularly use your hands, the Cincom portable hand massager is phenomenal. For less than $60 (on sale), you can get endless massages for both hands. There are six different settings for various styles and pressures, and a heat option as well.

As someone who plays a lot of racquet sports and types, this hand massager is a blessing. All you have to do is charge the hand massager for several hours, and then you're good to go cord-free for days.

2) Portable Foot Massager – Under $70

The next item to purchase is the Nekteck Shiatsu Foot Massager. For better health, I assume all of you regularly go for jogs or play sports. As a result, there's nothing better than to come home, take a shower, and get both a foot massage and a hand massage. This item is also less than $70 (on sale).

3) Warm Eye Masks – Under $35

If you suffer from dry eyes due to too much computer use or old age, your tear ducts are likely clogged. One of the best ways to declog them is to use heated eye masks for 10–20 minutes a day. I use a product called Rest: Self Heating Cornea Care, which has individually packed eye masks. You simply open the package, unfold the eye mask, and it heats up on its own for about an hour. They are super convenient for trips.

Put on these eye masks and relax as you listen to a Financial Samurai podcast episode (Apple). When you're done, you'll not only be more knowledgeable, but your eyes will also feel more lubricated. You can also use these eye masks when you nap or go to sleep, as they shut out the light. However, after about 30 minutes, you might start sweating too much, so it’s perhaps better to wait until all the heat has dissipated.

4) Curved Car Cleaning Brush – $25

I enjoy washing my own car for free. Not only does it feel relaxing, but it's also satisfying once I'm done. I used to clean my car with just a big sponge. Now, I use a curved cleaning brush with a telescopic handle to save energy. It is also necessary to clean the top of my car, which is relatively tall since it’s an SUV.

5) Front and Inside Car Dash Camera – Under $50

After almost being a victim of a car collision scam, I decided to protect myself and get a car dash camera. They used to cost hundreds of dollars, but now you can get them for less than $50. You don't need to pay for a brand-name one; you just need one that works and acts as a deterrent even if it doesn't work. There’s no need to pay someone to install it either.

If you are constantly commuting to work or dropping off and picking up your kids from school, getting a car dash cam is a no-brainer. The most exposure you will ever have to nefarious people is when you're out driving. So, do yourself a favor and protect yourself with your stock market returns.

6) Cervical Cooling Ergonomic Pillow – Under $45

After waking up with a painful neck crick that wouldn't go away for five days, I finally decided to research a more supportive pillow. I found one called the VIPfree Cervical Cooling Ergonomic Pillow. It's cut out in a way that supports the neck and cradles the head. It's also great for those of you who are side sleepers. We spend so many hours in our beds every night that having the best pillow is a must.

7) Toothbrush UV Sterilizer – Under $30

If your toilet, shower, and sink are all in one room, buy a wall-mounted toothbrush sterilizer. You use your toothbrush a couple of times a day (I hope), and it gets filthy if you don't clean it. Therefore, you might as well stay as hygienic as possible!

This version is compatible with most toothbrushes and comes with two separate slots for manual, sonic, rotary, and most slim toothbrushes. The LED screen displays battery status, cleaning progress, air drying status, and all functions at a glance. Simply wall mount it with the included adhesive strips and charge via Type-C (battery lasts ~30-days per charge).

8) Toto Washlet – Under $400

There is no better practical item to improve the quality of your life than a Toto Washlet. Using water to clean yourself is the best way to go—not just dry toilet paper. Further, this particular Toto Washlet has a heated seat, soft-close lid, plus adjustable warm water and pressure settings.

However, to install this beautiful product, you need access to an electrical outlet within four feet of the toilet. If the house is built thoughtfully, there will be an electrical outlet on the wall below the toilet. Before buying any house, make sure such electrical outlets are close by. In addition, you must have access to the water line. If you have a wall-hung toilet, you actually have to drill into the wall to find it.

You can easily install the Toto Washlet yourself if you have an electrical outlet nearby and a floor-mounted toilet. But if not, you can hire a plumber and get an extension cord.

I like the Toto Washlet so much that I decided to buy a $1,600 version for multiple bathrooms. But the $400-and-under version does 80% of the job, so it’s good enough!

9) A Copy Of Buy This Not That – Under $20

Now in its 5th print due to popular demand, you can pick up a copy of Buy This, Not That, my instant Wall Street Journal bestseller. This book is designed to help you make more optimal decisions, enabling you to live a better, more fulfilling life.

Give yourself or your loved ones the gift of financial wisdom. Beyond guiding you to build more wealth, it provides a precise framework for tackling some of life’s biggest dilemmas.

FinancialSamurai.com is an Amazon Associate. When you buy through links on our site, we may earn a commission at no additional cost to you. Rest assured your privacy is important to us and your personal information will never be shared or sold. Thanks for your readership and support.

Big Ticket Items to Buy With Your Stock Market Gains

Now that we've explored some affordable, fun, and practical purchases for your stock market gains, let's shift focus to bigger-ticket items. Some of you have multi-million-dollar stock portfolios, which likely means at least $1 million in stock market gains just for the year. Buying the things above isn't going to put a nick in your net worth.

If you’re not at this level yet, don’t worry. Be patient. With time, consistency, and the power of compounding, your investments can grow significantly, making these purchases feel much more attainable. Once you reach that point, you may face a new challenge: figuring out how to spend your wealth as it grows faster than you’re accustomed to spending.

1) A New or Gently Used Car – $30,000 – $200,000

If you drive daily, investing in a safe, reliable, and fun car can enhance your quality of life. Although car prices have surged since the pandemic, using stock market gains—essentially “funny money” where no effort was required—makes the expense feel less significant.

To maximize value, drive your new car for at least 10 years. With this ownership timeline, you'll likely only own 5–6 cars in your lifetime. Make each one count by choosing something you truly enjoy. And if you have kids, you might as well buy the safest car possible.

Personally, I like the latest Range Rover Sport. However, I also think it's time to get an EV after holding off all these years. My new house has solar and comes with an EV charger, so it feels like a waste not using it.

I'm very tempted to use some of my stock market returns to buy a new car in 2025. However, I can't get over how expensive new cars are. So I've devised another way to purchase a new car in an upcoming post.

2) Remodel Your Home – $5,000 – $500,000

If you spend significant time at home, consider remodeling heavily used spaces like kitchens and bathrooms, which offer the highest return on investment. And don't forget to add an electrical outlet near the toilet for that luxurious Toto Washlet upgrade!

For bigger projects, focus on increasing your home's livable square footage. Building upward, excavating downward, or creatively expanding can not only provide more space but also significantly boost your home's value. The key is to build at a price per square foot less than the selling price per square foot.

If a major remodel feels overwhelming, smaller changes like fresh paint, updated carpets, new appliances, and modern fixtures can still work wonders.

You can also use some of your stock market returns and buy some landscaping material and do the work yourself. We bought $150 worth of rocks and mulch to update our yard recently. Oh, and we also bought a new Meyer lemon tree for $65 and planted it with the kids. Now their responsibility is to water it twice a week and fertilize it once a month. So fun!

3) Buy a New Home $500,000 – $20,000,000

Perhaps the best way to leverage stock market gains is by upgrading to a nicer home. Unlike cars or appliances, a home is more likely to appreciate over time. In addition, to be able to enjoy your money daily is a dream come true.

There's nothing more satisfying than using stock market gains to buy a dream home and then seeing its value rise years down the line. It’s like getting paid to live in a better space. If you have a family, the returns on this investment—both financial and emotional—are even greater.

I shared my thoughts on buying a home I didn’t need, and it felt like a great lifestyle decision a year later. Living your best life now, rather than waiting for the perfect time, is important. After all, as we reach middle age and beyond, the risk that “tomorrow may never come” becomes very real.

More Fun Things To Splurge On With Your Stock Market Gains

- Floor seats to your favorite NBA or NFL game

- Premium orchestra seats to your favorite play or concert

- A luxury cruise with the family or as a special treat for your parents

- Renting a house in Hawaii for an unforgettable month during summer vacation

- Flying first class with the family on a two-week trip to Japan to indulge in the finest cuisine

- Hiring an interior designer to transform your home and help select new furniture

- Donating to a worthy cause and having your family's name proudly etched on a wall

- A rejuvenating day at the spa with your significant other

- Hosting an epic party for your favorite friends, complete with endless food, drinks, and entertainment

Don't Forget to Spend Some of That Free Stock Market Money

I hope this post has given you some ideas on how to enjoy your stock market returns. As you can see from the list, you don't need to spend a lot to get tremendous joy out of your money. There's something for everyone.

Get into the habit of selling some stock here and there to enhance your life. Otherwise, you might never fully enjoy the returns from your investments.

Personally, I can't believe the S&P 500 is up over 20% again in 2024, following a 24% gain in 2023. As someone who plans to withdraw 3%–5% of my portfolio annually in my 60s, anything over feels like free money. That’s why I plan to spend some of my stock market returns now to improve my quality of life today.

Tax-Efficient Spending Of Course

To spend tax-efficiently, consider using more of your dividend income instead of reinvesting all of it. Alternatively, allocate more of your active income for spending rather than selling stocks. In other words, temporarily lower your savings rate to avoid triggering capital gains taxes.

If you don’t plan to spend more when times are good, you’re unlikely to feel comfortable spending when times are tough. Be intentional with your spending, especially when it comes to your stock market returns.

Readers, what are some fun, cheap, and practical things you’ll spend your stock market returns on? Do you have any big ticket purchases you plan to make? Are you as blown away with this year's stock market returns as I am?

Subscribe To Financial Samurai

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Your shares, ratings, and reviews are appreciated.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. You can also get my posts straight to your inbox as soon as they are published by signing up here. My goal is to help you achieve financial freedom sooner. Everything is written based on firsthand experience.