Real estate is inherently local, with property values closely tied to the economic drivers and characteristics of specific regions. While understanding the national housing price forecast for 2025 provides valuable context, savvy investors should focus on identifying cities and states with stronger growth potential. After all, outperforming the market is just as important as generating returns.

One compelling area to watch is cities experiencing a higher percentage of workers returning to the office. Since 2020, millions of workers reaped the benefits of work-from-home policies, but there are growing signs that this trend is reversing.

As more companies push for in-office attendance, cities with robust office-based economies and increasing workplace reoccupancy rates could see a surge in housing demand. This shift may lead to greater property price appreciation in these areas as workers relocate closer to their offices, revitalizing urban centers.

Investing In Cities That Are Returning To The Office

Much like “Zoom Cities” such as Boise, Idaho, thrived during the remote-work boom, cities seeing a shift back to in-office work are likely to experience housing demand spikes. While most workers prefer flexibility, companies pushing for a return to the office will drive demand in urban areas.

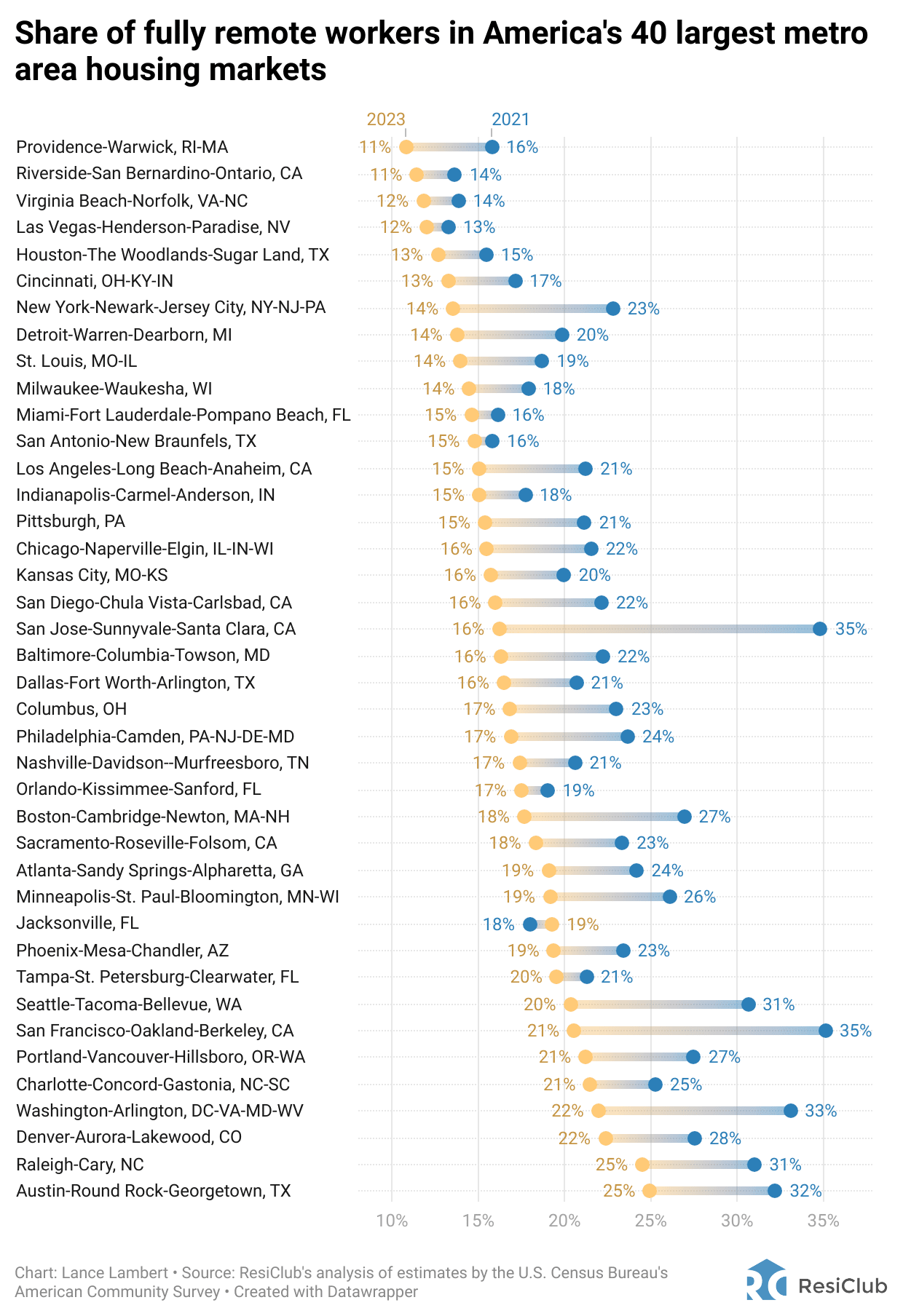

Recent data shows the biggest drops in fully remote workers are in metro areas like:

- San Jose-Sunnyvale-Santa Clara (35% fully remote down to 16% in 2023 and going lower)

- San Francisco-Oakland-Berkeley (35% -> 21%)

- New York-Newark-Jersey City (23% -> 14%)

- Boston-Cambridge-Newton (27% -> 18%)

- Seattle-Tacoma-Bellevue (31% -> 20%)

- Los Angeles-Long Beach-Anaheim (21% -> 15%)

- Washington, D.C.-Arlington (33% -> 22%)

Take a look at this more comprehensive chart compiled by Lance Lampert, writer of the ResiClub newsletter.

Common Theme Among Cities with the Greatest Return-to-Office Shifts

A key characteristic of cities experiencing the strongest return-to-office trends is their inherent difficulty in adding new housing supply. Years of undersupply have primed these cities for heightened competition, likely leading to bidding wars that drive up both rents and property prices. As more workers return, demand will rise for both residential and commercial properties, making these cities hotspots for real estate activity.

The transition won’t create an immediate boom. Initially, existing inventory will be absorbed as migrants and office tenants adjust to shifting dynamics. However, once return-to-office norms stabilize, the pressure on limited housing stock is expected to push prices higher. The interplay of strict land-use regulations and low loan-to-value ratios amplifies this effect.

Take San Francisco as an example. Building new homes is notoriously difficult due to stringent regulations and high construction costs. Securing a building permit often takes years, assuming the property is even zoned for development. Then you’ve got to build the darn structure! I tried getting a permit to build an ADU in the past and gave up after six months.

With tech companies thriving and enforcing hybrid work policies requiring at least three in-office days, housing demand is intensifying in tech hubs like San Francisco, San Jose, and surrounding areas.

The ongoing bull market is driving significant wealth creation, which not only attracts more workers to these areas but also channels substantial company stock capital into real estate investments.

The only way to truly enjoy your stock gains is to use them to buy something meaningful or fulfilling. This dual effect—rising demand from employees and heightened purchasing power from equity gains—further amplifies competition for housing in these high-growth regions.

The Return Of Big City Real Estate

Like so many things – politics, social justice issues, education trends, health trends – the pendulum tends to swing from one extreme to another. The Sunbelt and Midwest regions had their time in the sun from 2017-2022. Now, cities like Austin are dealing with a hangover as builders work through their inventory. Perhaps in 2026 or 2027, it will be boom times for them once again due to a then undersupply of housing.

But for next several years, I suspect big city real estate will start outperforming due to return to work policies. So if you own property in one of the cities with the greatest return to office shifts, I'd hold on. If you've been thinking about building a rental property portfolio, you may want to buy before a gigantic liquidity wave of tech and AI companies enriches tens of thousands of employees.

And if you've been a long-time landlord who is looking to simplify life and earn more pure passive income, your time to take advantage of strength and sell may be coming.

Employees And Employers Are Rational Actors

People who want to get paid and promoted will be complying with their company's return to office policies. And the vast majority of workers want to get paid and promoted.

Meanwhile, companies with senior management that once championed work-from-home policies are starting to recognize that fostering in-person collaboration is essential to stay competitive. They’re driven by the allure of mega-million-dollar windfalls. That’s capitalism in action!

Yes, it is sad that the good times are over for many who have to return to the office. But all good things must come to an end. At the very least, you can invest in companies that are taking work more seriously to drive earnings and returns for you. Then you can also invest in real estate in cities where those companies are based.

For lifestyle purposes, aim to work for companies that let you enjoy perks like playing pickleball in the middle of the day while still getting paid. These opportunities will become increasingly rare, so if you find one, value it as much as you would an honest auto mechanic or a dependable handyman.

Retirees Benefit From Return To Office As Well

For retirees, life gets a bit more peaceful. Booking courts, catching matinees, and strolling through parks will likely become easier without the same weekday crowds. Errands will take less time, and your favorite spots will feel less congested.

As millions return to fluorescent-lit offices in pursuit of more money, your decision to step away from the grind will pay off further—granting you greater serenity and freedom.

Psychologically, there’s a reassuring sense of satisfaction knowing that the employees in your investment companies are putting in more effort on your behalf. While investment returns are never guaranteed, it’s comforting to feel that the odds of maintaining a comfortable retirement are improving.

What a gift it is to see employees returning to the office and striving for growth once again!

Readers, what are your thoughts on investing in real estate in cities where employees are returning to the office in significant numbers? Do you believe big-city real estate is poised to outperform smaller markets that benefited from the work-from-home trend? Share your insights below!

Invest In Real Estate Strategically

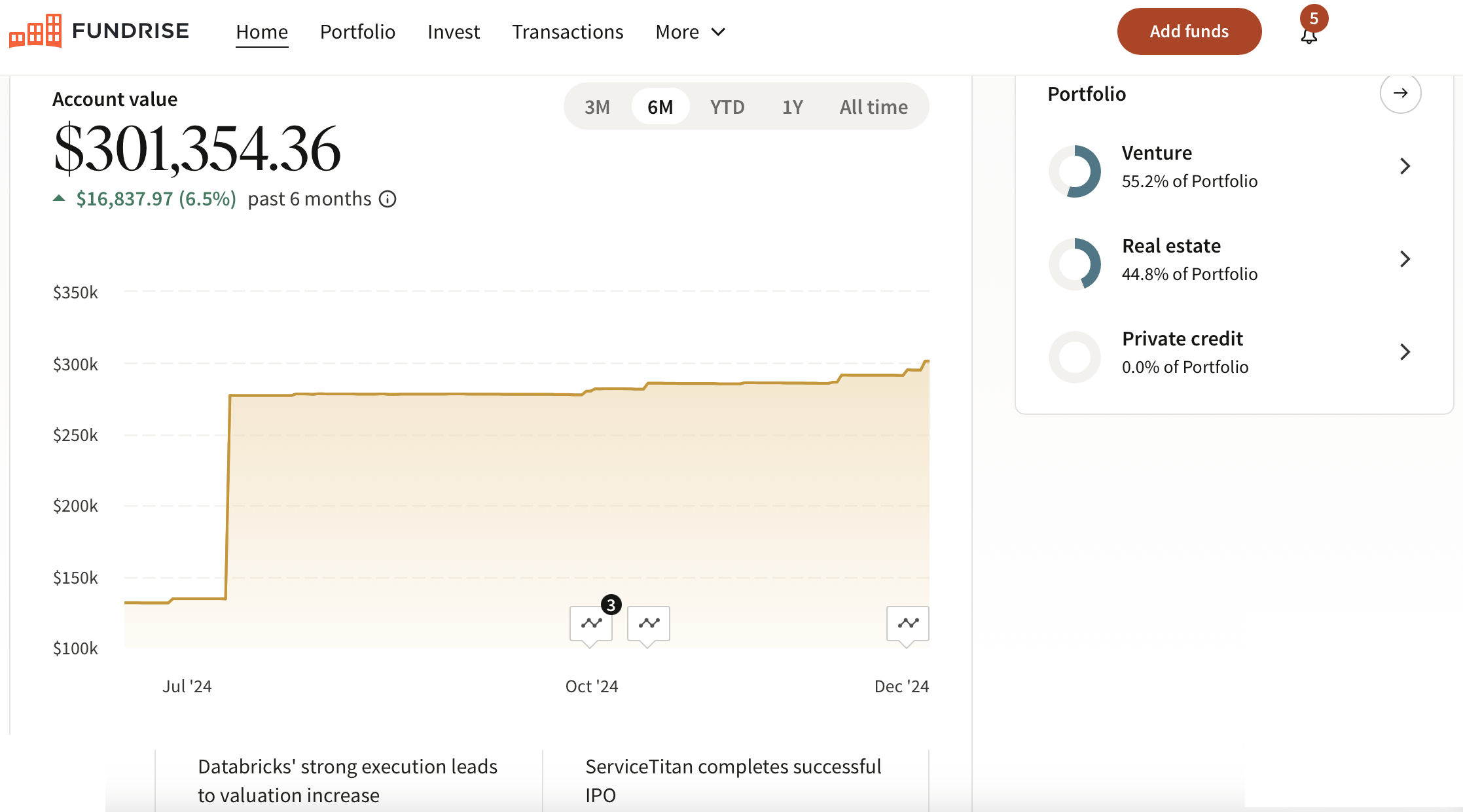

If you don't want to buy and manage physical rental properties, consider investing in private real estate funds instead. Fundrise is platform that enables you to 100% passively invest in residential and industrial real estate. With only a $10 minimum to invest, you can easily dollar-cost average into real estate without the hassle of being a landlord. .

I’ve personally invested over $300,000 with Fundrise, and they’ve been a trusted partner and long-time sponsor of Financial Samurai.